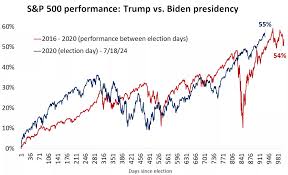

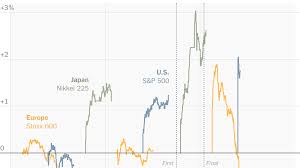

The US stock market surged by more than $1.28 trillion on the heels of the recent election results, marking a dramatic rally across major indices. The Dow Jones Industrial Average skyrocketed by 1,507 points, or 3.57%, closing at an all-time high. This represents the largest single-day point gain for the blue-chip index since November 2022. Similarly, the S&P 500 and the Nasdaq Composite both reached fresh record highs, with the S&P climbing 2.5% and the tech-heavy Nasdaq gaining 2.95%. Additionally, the US dollar experienced its strongest day in two years, and Treasury yields also saw a notable rise.

The market’s sharp rally was largely driven by the swift resolution of the election results. In the weeks leading up to the election, uncertainty surrounding the possibility of a contested result — particularly fears that former President Trump and his supporters might challenge the outcome in court — had weighed heavily on investor sentiment. This uncertainty had created a cloud of concern over both the broader economy and the stock market, as markets tend to perform poorly when there is ambiguity or the prospect of prolonged legal battles. With the election outcome now settled, investors gained clarity, which in turn boosted confidence.

This newfound certainty is seen as a major positive for markets, as it provides businesses with the stability they need to make long-term plans, particularly in areas like hiring, capital investment, and expansion. The clear electoral outcome is expected to help smooth out some of the volatility that has plagued markets in recent months, allowing companies to more effectively navigate the economic environment moving forward. For investors, the clarity of a defined path ahead, absent the threat of prolonged political instability, was a welcome relief, prompting the market’s significant upward movement.

Follow us on our socials @empfricfmradio for more updates.

1 Comment